To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.

Introduction

Keeping records is crucial for the successful management of a business. A comprehensive record keeping system makes it possible for entrepreneurs to develop accurate and timely financial reports that show the progress and current condition of the business.

For a business to be successful, its owner must possess a good blend of these skills: sales, customer service, management and record keeping. The sole proprietor must assume all the responsibility; but if the business has more than one owner or employee, it has the advantage of bringing sales, customer service, management and detail-oriented persons together to cover all aspects of the business.

Purpose

The purpose of a good record keeping system is to provide management information to use in operating the business. Because cash flow and profitability are closely tied to financial analysis, it is vital that the entrepreneur understand the external and internal financial factors that affect business.

The record keeping system provides the foundations for monitoring and measuring the progress of the business. It provides a blueprint for fiscal control by monitoring and measuring sales, costs of goods sold, gross profits, expenses and taxes. The entrepreneur should be involved in setting up the record keeping system and the chart of accounts, which includes elements that are critical in managing the day-to-day operations of the specific business.

Quick overview

Setting up a basic record keeping system

Many business finance professionals recommend that all entrepreneurs be knowledgeable about basic recordkeeping practices. The entrepreneur who decides to purchase a manual or computerized recordkeeping system, or has a bookkeeper or accountant, still needs to understand the basic premises.

The following is a simplified lexicon of basic record keeping that demonstrates how to set up yourown accounting system.

Journal: Journal is a book for recording business transactions in chronological order. A simple method of record-keeping is to use 13-column paper for journals. You derive the information for each journal entry from original source documents, such as receipts for cash paid or received, checks written or received, cash register tapes, sales tickets, etc. The information appearing on these documents must be analyzed to determine the specific accounts affected and the dollar amounts, then the proper journal entry is recorded.

Transaction: It is entered in a journal before it is entered in ledger accounts.Transactions are entered into the journals by date, amount, description and account to which the transaction has been assigned. For example, when rent is paid, the journal entry would be made in the cash disbursement journal under the accounts of cash and rent. A journal is also called the book of original entry.

Different journals are used for different source documents. Cash coming into the business (cash sales, bank loans, interest income) is entered in chronological order in a cash receipts journal. Cash going out of the business (expenses: rent, insurance, payroll, purchases,) is recorded in a cash disbursement journal. The check book is the source for recording disbursements.

Disbursements: It should be made by check from a business account that is separate from your personal bank account. This provides an audit trail in case of an IRS audit. Sales and Purchases on credit are entered into a sales journal and purchases journal, respectively. These journals are the original entry for the accounts receivable and accounts payable. A payroll journal is used to show employee gross wages, taxes/other deductions withheld and net wages. It also shows the employer’s share of FICA, Medicare and unemployment taxes. A general journal is used for miscellaneous entries and adjustments such as depreciation and inventory.

The accounting system is built around a list of account names called a chart of accounts and is organized under the categories of assets, liabilities, owner’s equity, revenue or income, cost of goods sold (for a business that sells a product), operating expenses and other income/expenses. The accounts you keep are tailor made for your particular business.

Assets are things of value owned by a business including cash, receivables, investments, buildings, land, equipment, vehicles, etc.

Liabilities are those amounts the business owes the creditors. They include payables, notes, loans, mortgages, etc.

Owner’s equity or capital (sometimes called net worth) is the investments of the owners and the accumulation of profit or losses for the business since it began. It is also the difference between

Assets and Liabilities

Revenue or income is the money that came into the business from the sale of goods and services.

Income is measured for a period of time.

Cost of goods sold is the cost of the product being sold by the business. A service type business will not have a cost of goods sold.

Operating expenses are the daily expenses in running a business. For example, rent, advertising, insurance, etc.

Other income/expenses are not daily necessities or a required part of the business operation.

However they are a part of doing business such as interest income and expense.

At the end of each month, all transactions are totaled and only the total of each account is posted to the general ledger on three-column paper. The general ledger is a cumulative (year to date) book that contains the individual accounts maintained by the business and shows the balances in each account.

Financial statements (Balance sheet and income statement) are prepared using the account balances from the general ledger.

The balance sheet is a financial report as of a specific date that lists the assets, liabilities and owner’s equity of a company. It is a “snapshot” of the business at a point in time.

The income statement or profit and loss statement (P&L) is the financial report that shows if the business had a profit or loss. It is the Revenue minus the Expenses

Single vs. double entry record keeping

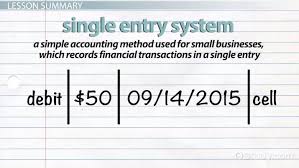

Single entry

Single entry is a simple listing of cash receipts and checks paid out. It is not a debit/credit system. It records monies received in a cash receipts journal (cash in) and monies paid out in the cash disbursements journal (cash out).

From these two listings, a simple profit and loss statement and cash flow statement can be developed. The single entry can be kept manually on a notepad or journal with columns labelled with your chart of account numbers.